Extra borrowing on mortgage calculator

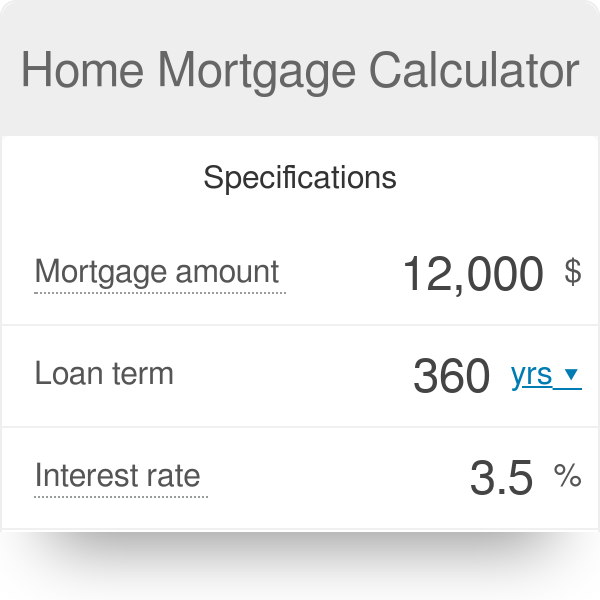

Using our mortgage rate calculator with PMI taxes and insurance. It considers the loan amount the annual rate of interest and the repayment frequency for calculation.

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Loan Originator Debt Relief

Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions.

. Read more we also have. Lump Sum Repayment Calculator. With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and plan your payoff strategy.

Lenders mortgage insurance calculator Capital gains tax calculator Extra lump sum payment calculator Mortgage repayment calculator Borrowing Power Calculator Income Tax Calculator Negative gearing calculator Rent or buy comparison Stamp duty calculator Split loan calculator Upfront ongoing cost calculator. Calculator is for illustrative purposes only. This is the best option if you are in a rush andor only plan on using the calculator today.

Mortgage fees and charges. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. If we do reduce your monthly payments the term of your mortgage will stay the same and you will pay off your mortgage in the same amount of time.

This is called your borrowing power. THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. Card and PIN services.

How much can I borrow. For information on how these results are calculated details are listed on our borrowing power calculator assumptions page. Mortgage Calculator zip file - download the zip file extract it and install it on your computer.

The default interest rate shown is a benchmark value is not specific to any one loan or lender and is subject to change. Applicants must be UK residents aged 18 or over. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. If youre borrowing a larger amount of money your mortgage payment may also be higher due to interest being charged on a larger principal balance. The calculators results page will return a loan option best fit for your needs including the length projected rates.

See how those payments break down over your loan term with our amortization calculator. The mortgage calculator from Lloyds Bank can help you compare mortgages understand how much you could borrow and what your mortgage repayments would be. A 225000 loan amount with a 30-yea r term at an interest rate of 3375 with a down-payment of 20 would result in an estimated principal and interest monthly payment of 99472 over the full term of the loan with an Annual Percentage Rate APR of 3444.

The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan product. Interest ratethe percentage of the loan charged as a cost of borrowing. Extra security for online shopping.

This is the best option if you plan on using the calculator many times over the. Chases mortgage affordability calculator creates an estimate of what you can afford and what your mortgage payments may be based on either. The seven-year high increases the repayments on an 800000 mortgage to 1000 a month since May.

Your mortgage might have other costs and fees such as set-up fees or appraisal fees that are necessary to get your. Allows extra payments to be added monthly. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE. This calculator helps you work out the most you could borrow from the bank to buy your new home. Borrowing 5000 at an interest rate of 3 taken over 20 years would cost you in interest payments thats just on the extra borrowing Yet borrowing 5000 at an interest rate of 3 over three years perhaps through a personal loan would cost you 23141 in interest.

Applications are subject to status and lending criteria. A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might influence future payments. Formula to Calculate Mortgage Payment in Excel.

Use our calculator below to see what Tuesdays increase of 50 points the right toggle button. Also check out our extra repayments calculator help you work out how making additional repayments on your mortgage could change the length of your home loan and your interest rate. Estimated monthly payment and APR calculation.

There are options to include extra payments or annual percentage increases of common mortgage-related expenses. Conforming Fixed-Rate estimated monthly payment and APR example. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.

Income If you calculate based on income the calculator will take information about your financial health and loan preferences combined with projected taxes and insurance to provide an estimate. Like many other excel mortgage calculator Mortgage Calculator A mortgage calculator is used to compute the value of the monthly installment payable by the borrower on the mortgage loan. Shows total interest paid.

The mortgage amortization schedule shows how much in principal and interest is paid over time. Our mortgage calculator can help you determine what mortgage you can afford by taking simple information about your finances and prospective home to predict your monthly payments including your principal and interest rate. Weve used our loan calculator to highlight some examples below.

Extra Mortgage Repayments Calculator. Our Excel mortgage calculator spreadsheet offers the following features. However mortgage interest isnt the only cost that youll need to pay.

The calculator updates results automatically when you change. Also this calculator has the ability to add an extra amount extra payment to the monthly mortgage and turbo charge your interest savings. Existing customer PPI information.

If you would like to pay off your mortgage sooner than planned please contact us on 0345 30 20 190 Relay UK - 18001 0345 30 20 190. Additional lump sum repayments can significantly reduce the amount of interest you pay on your home loan and the term of your loan. An offset account can be a powerful tool for those seeking a mortgage.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding. Mortgages can charge either.

Common Home Loan Mistakes We Provide Compliant Forms And Disclosures To Credit Unions Including Home Equity Home Loans Home Improvement Financing Home Equity

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator Money

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Downloadable Free Mortgage Calculator Tool

Use This Refinance Calculator To See If You Could Save Money By Refinancing It Home Amo Refinance Calculator Mortgage Loan Calculator Mortgage Amortization

Icici Bank Personal Loans With Privilege Banking Personal Loans Icici Bank Loan

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You

Financial Advisor Business Plan Template Lovely Create A Business Plan In Excel Personal Financial Planning Financial Plan Template Business Plan Template Free

Home Mortgage Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Borrowing Against Your Life Insurance Policy Life Insurance Policy Universal Life Insurance The Borrowers

Every Company Promise To You To Give The Best Services And Costumers Satisfaction But Costumers Get Personal Loans Loans For Poor Credit Small Business Loans

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

How Much A 350 000 Mortgage Will Cost You Credible

What You Need To Know About 401 K Loans Before You Take One